One of the standout features of the solution is its ability to automate almost 50% of manual repetitive tasks. This is achieved through LiveCube, a ‘No Code’ platform, that replaces Excel and automates data fetching, modeling, analysis, and journal entry proposals. Our blog articles are written independently by our editorial team.

The Formula for the Expanded Accounting Equation

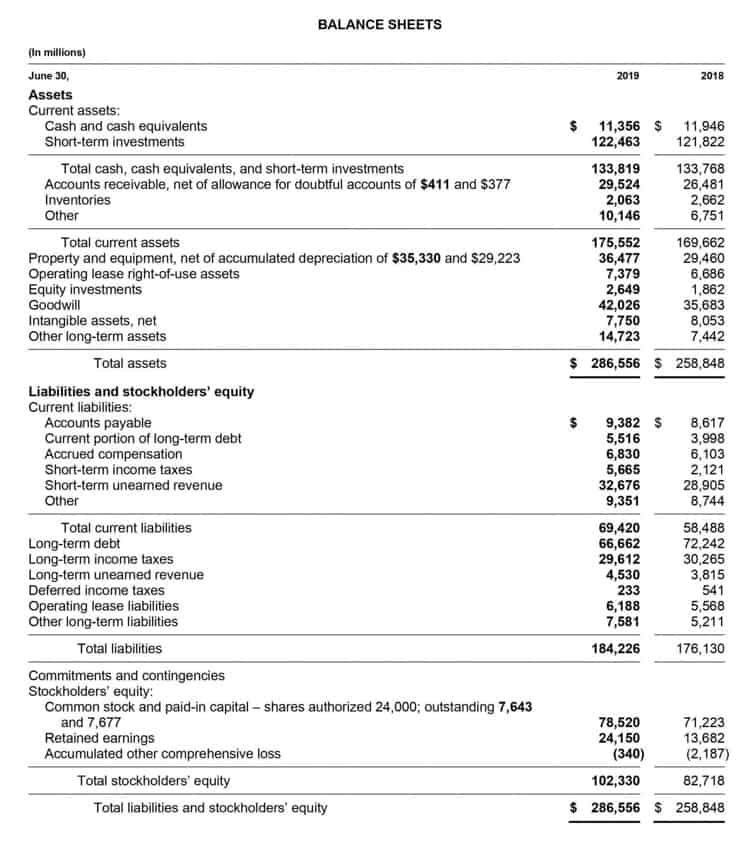

Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. Debt is a liability, whether it is a long-term loan or a bill that is due to be paid. The major and often largest value assets of most companies are that company’s machinery, buildings, and property.

Effects of Transactions on Accounting Equation

- For example, an increase in an asset account can be matched by an equal increase to a related liability or shareholder’s equity account such that the accounting equation stays in balance.

- Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid.

- This means Roth conversion planning requires predicting cash flow needs several years out.

- If you want to calculate the change in the value of anything from its previous values—such as equity, revenue, or even a stock price over a given period of time—the Net Change Formula makes it simple.

- With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt.

Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). You should also include contingent liabilities or liabilities that might land in your company’s lap.

What Is the Accounting Equation?

Here’s a simplified version of the balance sheet for you and Anne’s business. Right after the bank wires you the money, your https://www.bookstime.com/articles/what-is-another-name-for-a-bookkeeper cash and your liabilities both go up by $10,000. Now let’s say you spend $4,000 of your company’s cash on MacBooks.

Assets = Liabilities + Equity

The primary aim of the double-entry system is to keep track of debits and credits and ensure that the sum of these always matches up to the company assets, a calculation carried out by the accounting equation. It is based asset equals on the idea that each transaction has an equal effect. It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit.

How confident are you in your long term financial plan?

What is your current financial priority?

- This formula represents the accounting identity, which must always be true for all entities regardless of their business activity.

- The major and often largest value assets of most companies are that company’s machinery, buildings, and property.

- Retained earnings are all the profits made to date but unpaid to the owners in the form of dividends.

- SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

- The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

- If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction.

Which three components make up the Accounting Equation?

- The amount of each RMD is based on IRS life expectancy tables and account balances.

- The expanded accounting equation is a form of the basic accounting equation that includes the distinct components of owner’s equity, such as dividends, shareholder capital, revenue, and expenses.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- Being an inherently negative term, Michael is not thrilled with this description.

- A company’s financial risk increases when liabilities fund assets.

- However, each partner generally has unlimited personal liability for any kind of obligation for the business (for example, debts and accidents).

- It is, in fact, an expense and all expenses reduce retained earnings which is part of the shareholder’s equity.